KLIF Wheels Ed Wallace Again

Reports Misinformation Regarding the Federal Gift Tax

2023 May 13

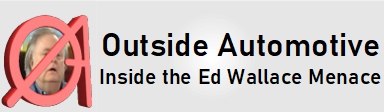

At the tail of his the April

29th Second Hand News Segment, Ed Wallace falsely asserted that SCOTUS Justice

Thomas must report to the IRS gifts that he received from Harlan Crow. This was

quickly debunked by both callers and by a post on Outside Automotive,

as it is the donor who must report the gift when the value exceeds gift tax

exemption.

At the start of his Second Hand News

Sleight of Hand News segment for May 6th, Ed Wallace admits that

this assertion was wrong. Justice Clarence Thomas was not responsible for

filing IRA tax form 709 for the gifts received from Harlan Crow. Then, having

corrected himself, Wallace immediately goes astray once again with more gift

tax misinformation.

|

Wheels with David El Attrache

and John Ingram

[…] “The issue was then convoluted by a couple of callers to the show, one pointing out you can give up to 11 million dollars of your own net worth to others tax free. In fact, I suggested to him that that was part of the law for the wealthy to pass on gifts to their spouses or relatives.“ […] “In generalization, you can give that money away tax free as gifts up to that limit for school tuition, charitable expenses, medical expenses, political donations or for spouses and your dependents.” […] “And while the donor who fills out

the 709 form is liable for the taxes… if they do not pay said taxes in that

fiscal year, the IRS can go and collect it from the recipient. |

The tax-free gift limit (a.k.a. gift tax exemption) is the amount of money one can give annually to one individual without any tax considerations. If one gives any one individual more that the tax-free gift limit, one must either pay a gift tax on that overage or debit that overage from one’s estate tax exemption.

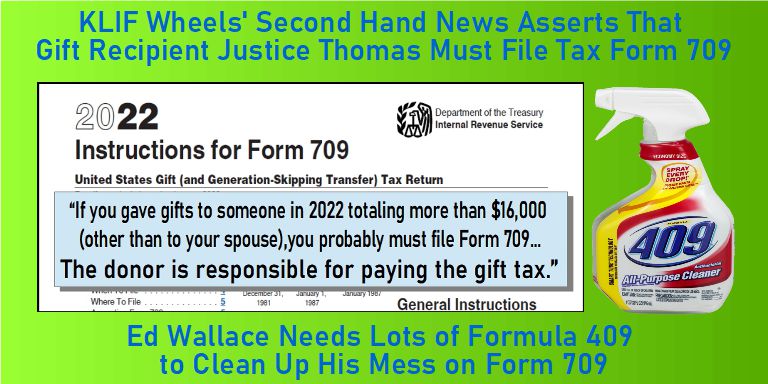

But, there are gifts to which no taxes or estate exemption debits apply. While Ed Wallace declares that “you can give that money away tax free as gifts up to that limit for […] spouses […]”, the IRS Form 709 Instructions clearly state that there are neither taxes nor 709 filings due for gifts to a spouse regardless the amount given (except for some uncommon situations such as spouse who is not a U.S. citizen). This can be found in the Gifts for Your Spouse section.

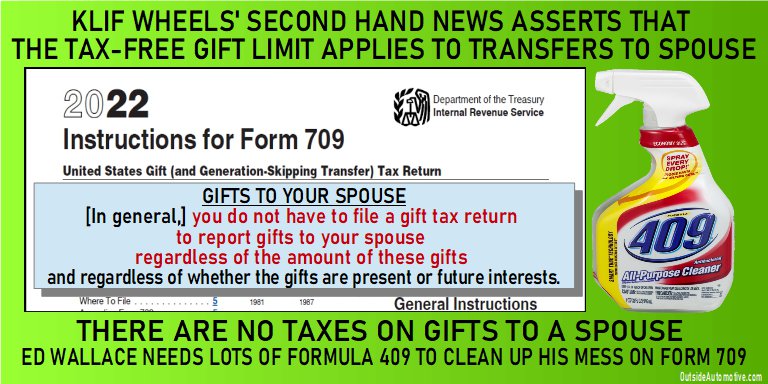

And when Ed Wallace declares that “you can give that money away tax free as gifts up to that limit for school tuition, charitable expenses, medical expenses, political donations [....]”, the IRS Form 709 Instructions clearly state that there are neither taxes nor 709 filings due for certain gift transfers regardless the amount given. This can be found in the Transfers Not Subject to the Gift Tax section.

Again, as per the IRS instructions for IRS tax form 709, there is generally no limit on gifts to one spouse. And there is generally no limit on gifts that are qualified medical, educational, charitable or political payments. Yet, despite supposedly discussing all of this with his own CPA, Wallace again broadcasts grossly inaccurate information. The IRS even posts a friendly FAQ page with this same information, which could have aided Wallace as the IRS Form 709 instructions appear to be above Wallace’s reading comprehension level.

This second time around, the audience was again anxious to correct Wallace’s latest gift tax misinformation. Wallace refused to take any calls on the topic, instead barking at his listeners to not call about form 709.

|

Wheels with David El Attrache

and John Ingram

[…] Ed Wallace But there were people who called us after that on the radio show and they said things that, in fact, weren’t 100%. They said person giving the gift was always responsible for the tax. Not true.” David El Attrache Ed Wallace […] “The only thing I had wrong on the story… the crux of the story… was who was responsible for filling out the 709 form. That is what I corrected. And, then, when I walked in this morning, I showed you guys this story that was front page on The Daily Beast yesterday. And what did it say? It said Clarence Thomas, Harlan Crow are about to learn about [crosstalk] gift taxes.” |

Ed Wallace goes on at length about how he corrects his mistakes. Yet, Wallace would not take any calls to address his latest batch of misinformation on form 709. So, despite Wallace’s own statements being far from 100% correct, he slights the prior week’s callers for not providing 100% complete information. It is true that the recipient might be required to pay the gift tax should the donor fail to pay it. However, in this specific case of Justice Thomas and Harlan Crow, Harlan Crow will pay the gift taxes should these taxes be due, as billionaire Crow is primarily responsible and has sufficient assets. Given his past generosity towards Thomas, Harlan’s past is prologue and Harlan pays the bill. So, that “caller not 100% correct slight” dismissal distills down to omitting a rule caveat for a scenario that is extremely unlikely for the specific case being discussed.

Ed Wallace says that he sticks with the crux of his original story, which he claims was: “These major gifts are supposed to have a paper trail. And it goes through the IRS.” But that was not the crux of his first story. If one actually ♫ listens to his original story, the crux of Ed’s story was that conservative Supreme Court Justices do not obey federal laws, first with being the ethics laws passed after Watergate and second being the IRS gift tax laws. That crux is false, as Justice Thomas has no current obligations under the federal gift tax laws. Harlan Crow is responsible for the filing and payment of any gift taxes. And Crow has the assets to pay any such taxes.

To bolster his fraudulent position, Wallace exercises his recurrent deceptive of technique of presenting a partisan editorial as if it was a straight news story. In this case, far-left website The Daily Beast published an opinion piece titled “Harlan Crow and Clarence Thomas Are About to Learn About Gift Taxes”. The banner of the article explicitly states that it is ‘OPINION’. Yet Wallace calls it a “story”, misleading the audience to think it was a news story.

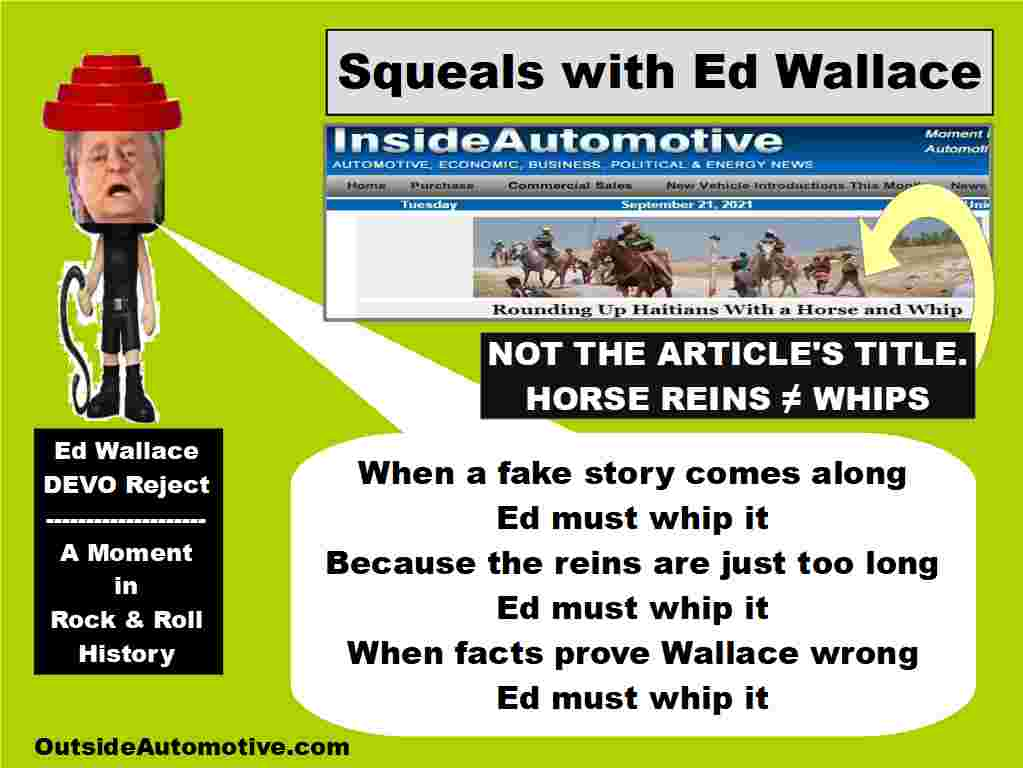

A news conference this week brings forth a prior event where Wallace applied

this deceptive tactic of pushing partisan editorials when the straight news

stories do not support his agenda. In that conference, Democrat Department of

Homeland Security Secretary Alejandro Mayorkas

corrected a reporter who asserted that Border Patrol agents whipped migrants,

stating in no uncertain terms that this did not happen.

When the border patrol was first accused of hitting Haitian immigrants with whips, the truth that the patrolmen were actually maneuvering horses with long reins was known before the day was over. That did not deter Ed Wallace from posting large headlines declaring ‘whips’ on his Inside Automotive web site to push “Rein of Terror” fake news. When that position was untenable to hold on the second day, Wallace linked to an editorial from an open-borders advocate that changed the fiction to “Border Patrol Uses Reins Like Whips”.

So, past is prologue. When a useful false narrative comes along, be it Justice Thomas violating IRS gift tax law or the border patrol striking immigrants, Ed must whip it.

-- Related Stories --

2023/05/03 - Ed Wallace Falsely Asserts that SCOTUS Justice Thomas Must Report Gifts Received to the IRS