Ed Wallace Falsely Asserts that

SCOTUS Justice Thomas Must Report Gifts Received to the IRS

2023 May 2

Despite the alleged host change, Ed Wallace’s Second

Hand News Sleight of Hand News continues with its propaganda. But

none were as conspicuously fraudulent as the April 29th mudslinging

targeting Supreme Court Justice Clarence Thomas.

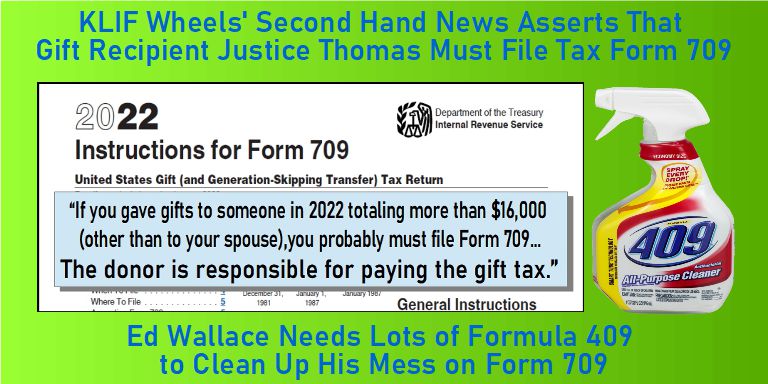

Over the past few weeks, there have been many news stories about the gifts received by Justice Thomas from Texas billionaire Harlan Crow. The mainstream media, of which Ed Wallace is a subservient member, is determined to convince the public that these gifts were a violation of the ethics laws regulating the Supreme Court. The facts surrounding these gifts do not support that conclusion. And with the public not convinced, Wallace tries a new tact by asserting that the gifts likely resulted in Justice Thomas violating federal tax laws.

|

Wheels with David El Attrache

and John Ingram

Wallace wraps up the segment as follows: Ed Wallace […] “As for those working for the IRS,

maybe you should ask your supervisors to check to see And yet he’s a supreme court justice.” |

The above segment had the shelf life of an ice cream cone on a sun, as the first caller to the show quickly debunked Ed’s accusation.

|

Wheels with David El Attrache

and John Ingram

Ed Wallace John Ingram Caller ‘Beverly’ Ed Wallace Caller ‘Beverly’ Ed Wallace |

The recipient (Justice Thomas) of a gift neither reports the gift to the IRS nor pays tax on it. The donor (Harlan Crow) who gives the gift is responsible for reporting (form 709) the gift and paying any associated taxes. Wallace’s take is greasy, mudslinging fiction.

The story about the gifts to Thomas has been in the news for weeks. Furthermore, Second News Segment was scripted and recorded before the Saturday broadcast. So, there was adequate time for the facts to have been checked prior to Ed airing his misinformation. But, as per his prior conduct, Wallace is not one to let a false narrative go to waste.

Wallace told caller Beverly that he did review both the 709 form and its instructions when researching his “news” report on Justice Thomas. If that were the case, how did Ed Wallace miss the following found within “Who Must File” section, which is located at the top of the IRS instructions for form 709.

IRS Form 709 Instructions:

Who Must File

In general. If you are a citizen or resident of the

United States, you must file a gift tax return (whether or not any tax is

ultimately due) in the following situations.

■ If you gave gifts to someone in 2022 totaling more

than $16,000 (other than to your spouse), you probably must file Form 709. But see Transfers Not Subject to the Gift Tax and

Gifts to Your Spouse, later, for more information on specific gifts that are

not taxable.

[…]

■ The donor is responsible for paying the gift tax. However, if the donor does not pay the tax, the

person receiving the gift may have to pay the tax.

[…]

Any bets that Ed

Wallace says that he misread the Form 709 instructions? And yet he is a

self-proclaimed economics expert.

Soon after caller Beverly hangs up, caller Ron was on the phone with Wallace to set him straight on the gift tax.

|

Wheels with David El Attrache

and John Ingram

Ed Wallace Caller ‘Ron’ Ed Wallace Caller ‘Ron’ Ed Wallace Caller ‘Ron’ Ed Wallace |

Ron is not a tax professional. But he quickly learned how the gift tax worked and how it is closely tied to the inheritance tax.

But the audience was still not through with Wallace. As the show came to a close, Wallace announced that his e-mail inbox is full with listeners contesting his fake news.

|

Wheels with David El Attrache

and John Ingram

John Ingram Ed Wallace They say that, in fact, the 709 form is the responsibility of the person who gave the trip. But my CPA said, if it exceeds the limit, if not a gift, then it could be considered income to Thomas. All the rest said ‘yea, he doesn't owe anything’. So there you have it.” |

Wallace’s laments about CPAs fact-checking him are a deflection. His audience comprises not of all financial professionals. But the audience does comprise of a demographic of a certain age that holds modest (at least) assets. Gift tax considerations are amongst the first steps of estate planning. These are basics that one learns within the first 15 minutes of studying the matter. So, Wallace’s audience can quickly flag his misinformation regarding the gift tax.

A large quantity of Formula 409 is needed to clean up Ed Wallace’s greasy behavior regarding IRS form 709.

If one must learn about gift taxes from the radio, do not expect accurate information on that topic from car salesman Ed Wallace performing on a car dealership infomercial like Wheels. Instead, listen to an infomercial from someone with that expertise.

|

Money Matters with Ken Moraif

So the first question is what is a gift? So a gift is when you give money or property or so to someone else with nothing in return. And nothing promised to you in return either. So that's what's called a gift. You give somebody something with nothing in return coming from it. Ok? So anything that falls under that is a gift. And the thing about it is that if you make gifts, then there is a gift tax and the reason there's a gift tax is because back when they created the estate tax, which is a tax that you pay upon your death. People figured out that I can give everything away before I die. And therefore I would owe no estate tax. And so then the government and their infinite wisdom said, oh yeah, we get, if that's what you're gonna do, then we're gonna charge you a gift tax that's the same as the estate tax if you give away too much of it. And that way you can't get away with it. And everybody went ‘darn those people’. Anyway, so who pays the gift tax? The tax is paid by the donor, the person making the gift.” [Examples…] “The key thing to remember though is that the gift tax itself is paid for by you and any gains taxes are paid by the recipient.” |

Currently, what was once the fifth hour of the Wheels radio show is an infomercial for the McClure Capital financial services. This infomercial runs as a noon simulcast on both KLIF and KRLD. To avoid further dissemination of misinformation to the KLIF audience, KLIF should repeat this action and reallocate the fourth hour of Wheels to another KRLD financial retirement services infomercial (Money Matters with Ken Moraif).

Ed Wallace presents himself as an expert on economics. Yet, Wallace repeatedly exposes himself as incompetent in handling his own personal finances. First, he confesses that his credit card statements go unchecked for months, which is the most basic of actions to protect oneself from fraud and errors. Now, Wallace exposes his ignorance of the basics of estate planning. The guy is 70 years old. And while his net worth may not be the posted $450 million, Wallace has broadcasted that he owns considerable assets in the form of at least two homes. So, while the current estate tax exemption is historically high, it is scheduled to be cut in half in the year 2026. Furthermore, if the politicians that Wallace pushes have their way, that exemption could easily shrink to a level that afflicts his own assets. If one point this out, Wallace would likely snark that “you’re selfish” while concurrently attempting to circumvent those taxes for himself.

Let’s conclude in the manner Ed Wallace does: You know, there is nothing like a thug’s

bloviating, trying to accuse others of an ignorance of which he possesses.

-- Related Stories --

2023/05/13 - KLIF Wheels Ed Wallace Again Reports Misinformation Regarding the Federal Gift Tax